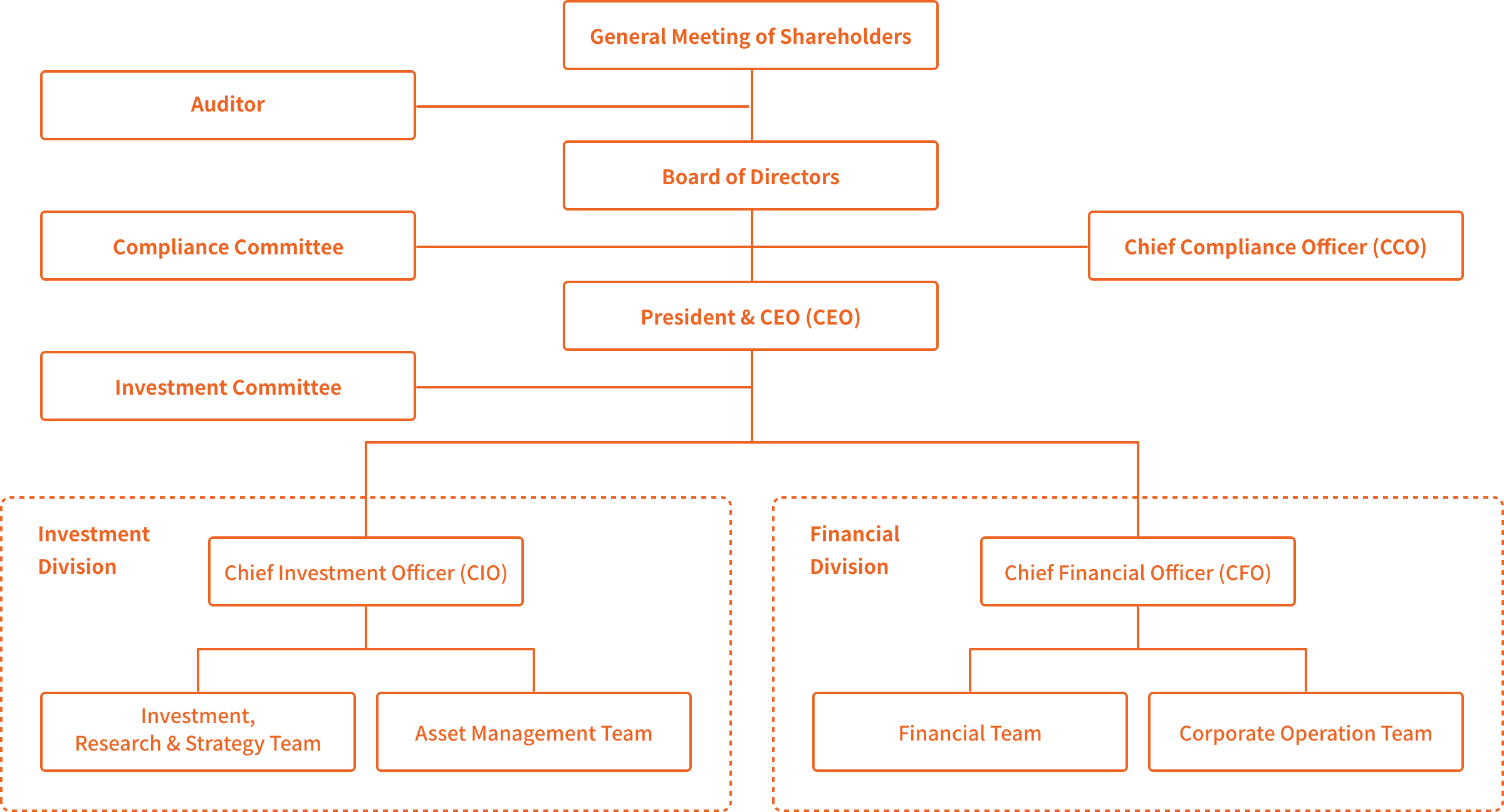

Management Structure

MAF’s asset management is consigned to the Asset Management Company. The Asset Management Company conducts operations under the following organizational structure based on the REIT Management Agreement entered into with MAF.

For details of Management Structure, please refer to "Corporate Structure, (3) Management Structure of MAF (Excerpts from the Securities Report)."

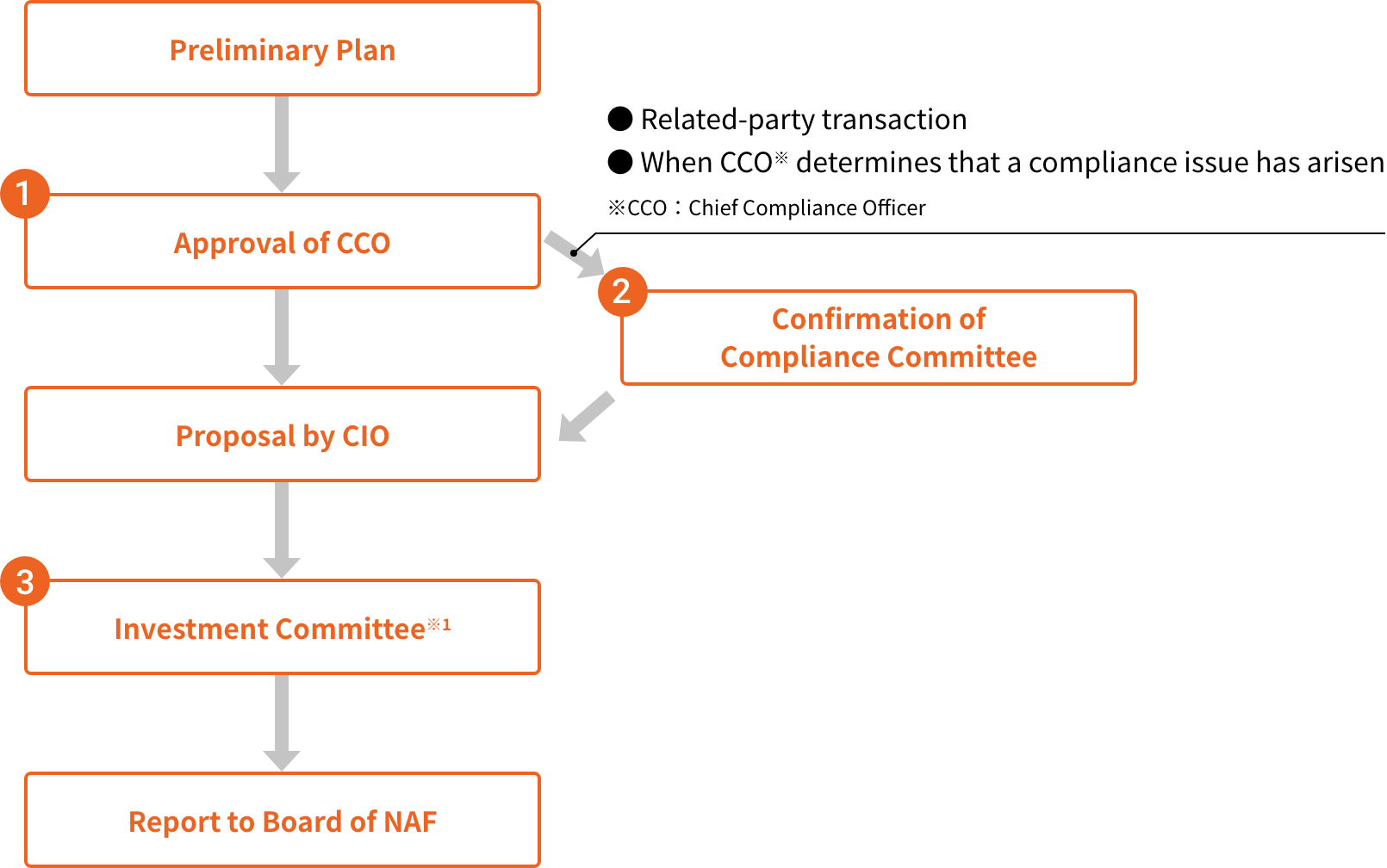

The Asset Management Company’s Decision-Making Process Flow for Acquiring or Selling Investment Assets

The Asset Management Company’s Decision-Making Process Flow for Acquiring and Selling Assets Under Management

- *1 When MAF acquires or sells of assets in transactions with related parties as defined by the Investment Trust and Investment Corporation Act of Japan, the Asset Management Company must obtain consent from MAF based on the approval of MAF’s Board of Directors prior to the deliberations of the Investment Committee. However, such consent is not required for property or other real estate acquisitions stipulated by Article 245-2-1 of the Investment Trust and Investment Corporation Act as having immaterial impact on MAF’s assets because the acquisition cost represents less than 10 percent of the book value of MAF’s investment properties.

Compliance Checking System

1Approval by Chief Compliance Officer (CCO)

The following require approval of the Compliance Committee

- Related-party transactions*2

- When CCO determines that a compliance issue has arisen

*2 Property acquisition price from sponsor-related parties is below appraisal value

2The Compliance Committee

The Compliance Committee

Members: CCO (Chairperson),

CEO, 2 external professionals (Currently 1 lawyer and 1 CPA)

External professionals: Appoint professionals independent from sponsor-related parties

Resolution: Requires the votes of 2/3 or more members and at least 1 of the 2 independent external

professionals

3Functions as a Check on the Investment Committee

CCO can suspend discussion when he sees any problem in the discussion process