Financial Strategy

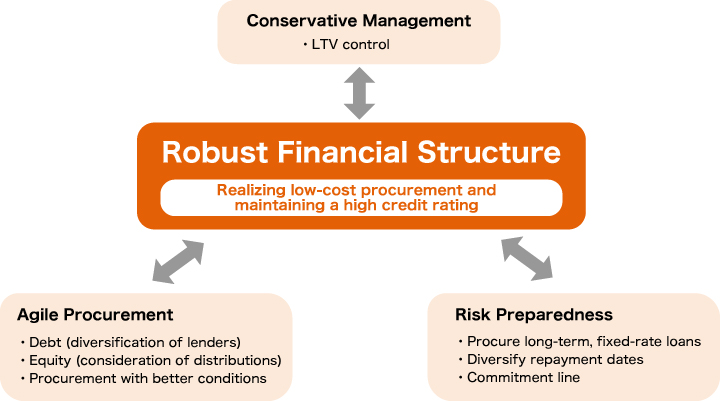

Concerning financial activities, which is key in management for increasing unitholder value, MAF conducts strategic and conservative financial management in order to realize efficient and low-cost financing and maintain high issuer ratings.

Procurement of Funds

Issuance of Investment Units

MAF may flexibly issue additional units with the objective of financing acquisition of assets, renovation, and other capital requirements for operation, or to repay debt, including lease deposits, security deposits, loans, and bonds that MAF may have issued.

Debt Financing

In light of the conditions outlined below, MAF may procure loans from financial institutions. Moreover, investment corporation bonds may be issued for the same purpose.

| Loans | Investment corporation bonds | |

|---|---|---|

| Use | Acquisition of assets, renovation, and other capital requirements for operation, payment of distributions, or repayment of debt | |

| Maximum amount | To not exceed 1 trillion yen in total | |

| Lender | Qualified institutional investor as defined in the Special Taxation Measures Law | ― |

| Collateral | Assets under management may be used as collateral | |

Procurement Policy

Conservative Management

The target upper limit of MAF’s interest-bearing debt against total assets (LTV) is 60%. The LTV may, however, exceed 60% temporarily due to acquisition of assets. Conservative management will be implemented, and past LTV performance is as shown below.

Change in LTV

Unit:%

Agile Procurement

MAF will consider appropriate procurement methods and exercise agile procurement of funds in accordance with the need for funds for acquisition of assets or repayment of loans. We will aim to procure funds with the most advantageous conditions backed by the highest-level credit rating for residential J-REITs.

Risk Preparedness

As a countermeasure against the future risk of rising interest rates, MAF actively acquires long-term, fixed-rate loans as well as diversifies repayment dates in procuring interest-bearing debt. We also have commitment line agreements of a certain amount in preparation for when a temporary need for funds arises.