Portfolio Structure Policy

1. Proportion of Investment in Assets

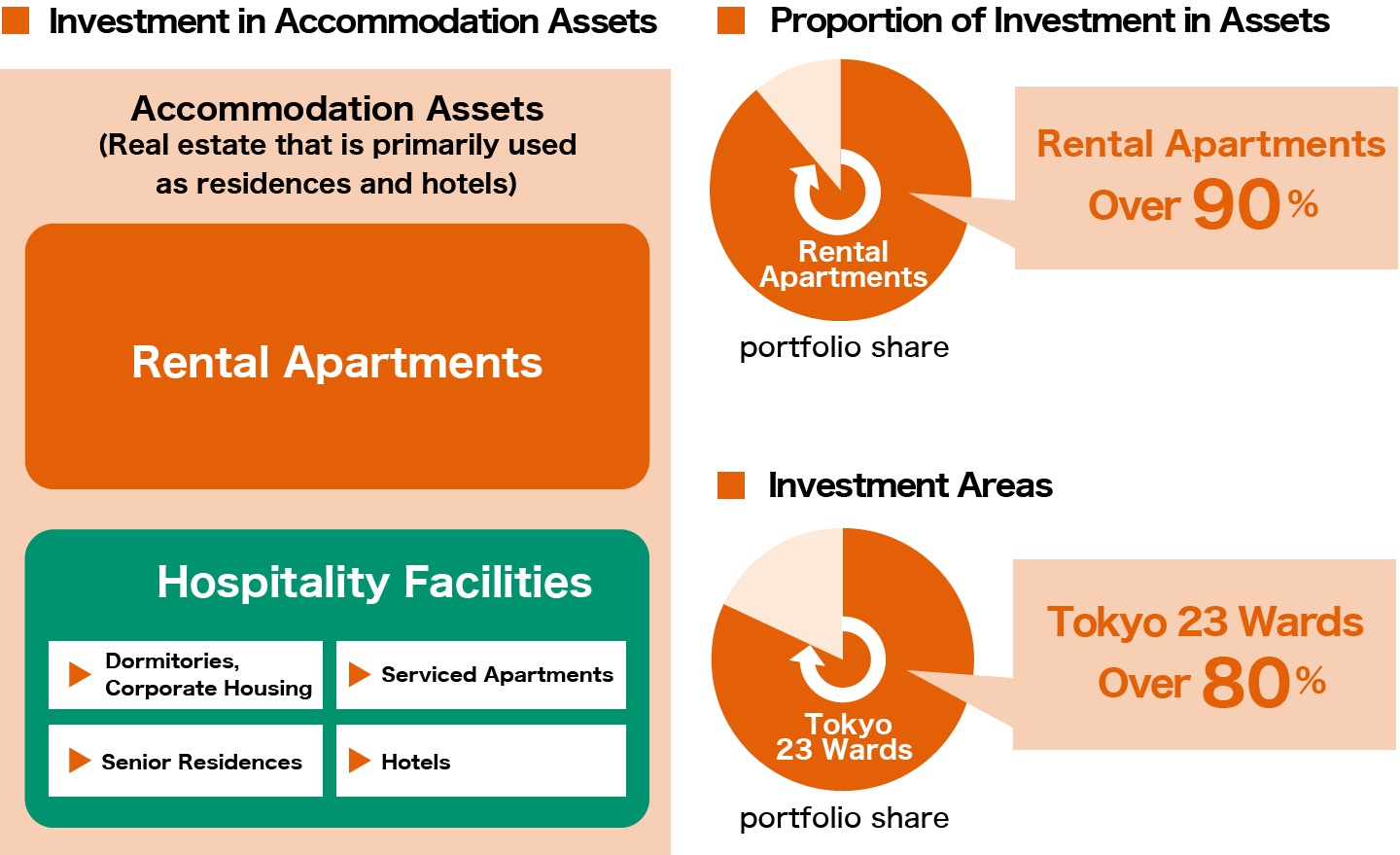

MAF invests mainly in rental apartments, and currently limits investment in hospitality facilities to a maximum of 10 percent of the total portfolio value on an acquisition price basis.

2. Investment Areas

MAF emphasizes Greater Tokyo (see Note 1, below), mainly the 23 wards of Tokyo, and Other Major Cities (see Note 2, below) in investing in rental apartments, while it focuses on major cities throughout Japan and their suburbs in investing in hospitality facilities. MAF invests in accommodation assets located in areas where there is substantial demand, depending on the characteristics of each asset.

By region, at least 80 percent of MAF's assets, including rental apartments and hospitality facilities, are located in the 23 wards of Tokyo on an acquisition price basis. MAF studies regional characteristics and tenant needs to invest in properties with suitable building plans and characteristics.

| (Note 1) | "Greater Tokyo" refers to Tokyo, Kanagawa, Chiba and Saitama. |

|---|---|

| (Note 2) | "Other Major Cities" refers to each of the urban areas of Sapporo, Sendai, Nagoya, Osaka, Kyoto, Kobe, Hiroshima and Fukuoka cities. |