Corporate Governance Structure

Growth Strategy

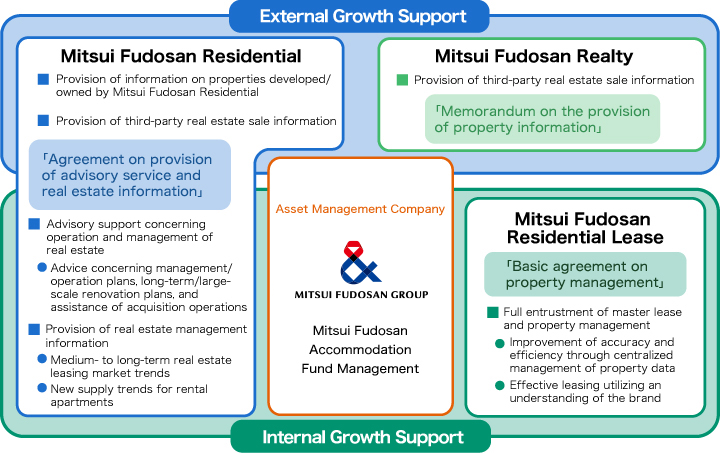

MAF utilizes to the fullest extent the comprehensive capabilities of the Mitsui Fudosan Group, such as in information gathering, planning/development, and management/operation, in order to achieve its external and internal growth. For these aims, the Asset Management Company has concluded the following support agreement with the Mitsui Fudosan Group.

External Growth

The Asset Management Company endeavors to make possible MAF’s stable and ongoing acquisitions of Accommodation Assets owned/developed by the Mitsui Fudosan Group. Moreover, acquisitions of competitive and excellent properties will be made from outside the Mitsui Fudosan Group as well through the utilization of the Mitsui Fudosan Group’s information network and the Asset Management Company’s information-gathering route in an aim to realize steady external growth.

a. Utilization of the Agreement on Advisory Service and Provision of Real Estate Information with Mitsui Fudosan Residential

The Asset Management Company has concluded an agreement on provision of advisory service and real estate information with Mitsui Fudosan Residential (the “Company”) in order to obtain and maintain opportunities to acquire quality Accommodation Assets. The details of the agreement are as follows.

- 1. Disclosure of asset management guidelines

The asset management guidelines of MAF are disclosed to the Company, and thoughts on expanding the portfolio are shared. - 2. Provision of information on real estate, etc. owned/developed by the Company.

If the Company is to sell a real estate property, etc. which it owns or has developed, preferential negotiation rights* are granted.

*Preferential negotiation rights: Having provided the information to the Asset Management Company prior to provision to third parties, if the Asset Management Company then indicates through a written document its intention to consider the purchase of the real estate property, etc. based on the information provided, the Company shall consider MAF with at least the same level of priority as any third-party candidate. - 3. Provision of third-party real estate sale information

Provision of third-party real estate sale information by the Company in line with the asset management guidelines. - 4. Provision of real estate management information

Provision of information on management of rental apartments, etc. (qualitative assessments and quantitative data on the market environment concerning rental apartments, dormitories, and corporate housing) by the Company. - 5. Provision of advisory services

Technical advisory concerning building facilities (investment advisory is not included).

b.Utilization of the Information Capabilities and Information Network of the Mitsui Fudosan Group

The Asset Management Company concluded a memorandum on the provision of property information with Mitsui Fudosan Realty so as to utilize the expansive information network of Mitsui Fudosan Group companies and obtain opportunities to acquire quality Accommodation Assets.

c.Distinctive Information Gathering of the Asset Management Company

In addition to obtaining property information from the Mitsui Fudosan Group, the Asset Management Company develops a distinctive information-gathering route and works to acquire quality accommodation assets.

Internal Growth

By maintaining customer satisfaction and asset value over the long term, maintaining and increasing rents and occupancy rates, as well as reducing costs through optimal management/operation that utilizes the brand strategy and tenant services of its assets under management as well as the value chain and high-level expertise knowhow of the Mitsui Fudosan Group, the Asset Management Company aims for steady internal growth.

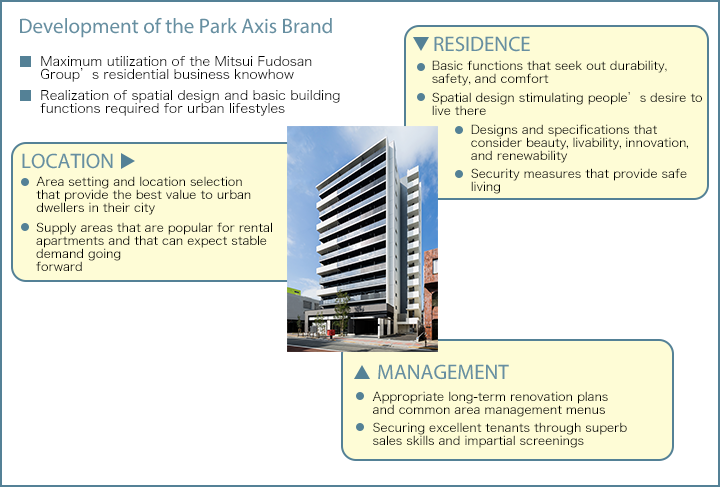

a. Brand Strategy

With regard to rental apartments, MAF's primary assets under management, we build our portfolio by positioning the Park Axis series planned and developed by the Mitsui Fudosan Group at the core of brand strategy along with the Park Cube series which is similar in quality with the Park Axis series.

In order to enhance recognition and familiarity of the Park Axis and Park Cube series as high-quality residence brands in the rental apartment market, the Asset Management Company develops its brand strategy, including provision of the following Park Axis quality to residents over the long term, by collaborating with the Mitsui Fudosan Group.

Park Axis Quality

| Basic performance | Features of the building such as earthquake resistance, durability, and sound insulation in light of the locational and building features are realized with high quality. |

|---|---|

| Safety and security | Through various security equipment, security measures, quake-resistance devices, health-conscious specifications, and such, daily urban living offering a sense of safety is provided. |

| Spatial design | Excellent functionality and beautiful spatial design are provided in building exteriors, greenery, entrances, as well as residential layout, storage, and even the position of electrical outlets. |

| Maintenance | Buildings maintain asset value over the long term with the provision of simplified maintenance characteristics for rental apartments and facilities/specifications with excellent renewability. |

| Environmental performance | Initiatives to reduce energy consumption as well as light and fuel expenses are promoted while allowing comfortable living. |

b. Excellent Services for Residents

The Asset Management Company realizes a high level of customer satisfaction by improving residents’ convenience and comfort and providing residential spaces that are safe and secure. Below are the services provided to residents at MAF’s assets under management. The Asset Management Company will further expand its services in collaboration with the Mitsui Fudosan Group.

Services for Improving Convenience

| Mitsui Housing Loop |

Mitsui Housing Loop is a membership service for those using residential-related services of the Mitsui Fudosan Group (admission procedures required).

|

|---|---|

| Concierge* |

Dedicated staff are positioned for receiving inquiries from residents, providing agency functions for various services, and responding to visitors.

<Details of service> Staff will greet residents when arriving at or departing the property, provide agency functions for various services such as cleaning and respond to inquiries from residents and guests. Furthermore, with bilingual staff, housekeeping, and more, we provide services in coordination with partner companies.  |

| Household Services* |

Services that improve convenience for residences, such as housecleaning, leasing of furniture and appliances, catering, and housekeeping, are provided in collaboration with other companies. |

| No-Guarantor System | Under this system, no joint guarantor will be required for residents as they will pay a guarantee fee to a surety company which operates between the lessor and resident. |

Services to Ensure Safety and Security

| Customer support window: C-desk |

We provide an around-the-clock, toll-free service for accepting/responding to requests for rent renewal and issuance of certification for parking spaces as well as troubleshooting for devices including problems regarding water leaks, air-conditioning, and water heating.

|

|---|---|

| Tenant Guidebook |

Residents are given a “tenant guidebook” for comfortable and secure residential living, outlining various key points for living in condominiums, such as notes on moving, disaster prevention, manners/rules in joint residences, and use of facilities such as gas stoves.

*At some properties, guidebooks specific to the property are distributed.  |

*These services are limited to a portion of assets under management.

c. Property Management

(i) Rental Apartments

The role of the property management company of rental apartments is to execute tenant management and propose/execute measures concerning building management. Therefore, it is essential that they possess expertise that demonstrates mastery of the line of work as well as organizational and effectual capacities for performing operations in providing high-quality, consistent services targeting a multitude of dispersed properties/tenants.

The Asset Management Company has entrusted property management operations to Mitsui Fudosan Residential Lease as a party able to realize high quality and consistency in services, and has concluded a basic agreement on property management.

・Leasing

・Contract-related operations

・Deposits and withdrawal

・Tenant correspondence (including move-ins and departures)

Building management

・Management of common areas

・Maintenance and inspection of buildings and facilities

・Formulation of building maintenance/management plans

・Repair, renovations, and updates for buildings and facilities

・Providing reports to the Asset Management Company

(ii) Hospitality Facilities

In regard to hospitality facilities, the Asset Management Company selects the operator or firm as the lessee individually upon consideration of the business and operational system of each facility. In principle, MAF leases to the operator or firm through a comprehensive lease, entrusting the operation of facilities and property management to the lessee.

d. Maintenance of Asset Value

The Asset Management Company pays constant attention to the status of assets under management and tenant satisfaction through the property management company and endeavors to formulate optimal renovation plans which maintain asset value over the long term. According to the building age of assets under management, agile and effective capital expenditure are implemented from the viewpoint of increasing competitiveness, security, and tenant amenity.

In formulating and implementing renovation plans, we select valid and effective methods by utilizing the technical strengths and knowhow accumulated by the Mitsui Fudosan Group in its residential business and accommodation business, bringing in also the perspective of outside experts.